When your money sits in the bank, you earn some interest, so why not make some extra income on your stocks and gold while they sit in your broker's vault. Dividends aren't the only way to make money on the stocks you hold long-term. "Call options" can give you some extra income on those stocks for the years they are sitting idle in an IRA account (or even in a regular account).

Here's a quick guide to how it works.

Call options are a right to buy a stock at a specific price between now and a future expiration date. If I buy an IBM December 200 call, it means I have the right to buy 100 shares of IBM for $200 per share any time between now and December, regardless of the market price. Even if IBM is at 225 in December, I can buy it for $200. I can also just sell the call for the difference in price between the two, and pocket the profit. However, from a seller's standpoint, I am selling the right to someone else, who may buy my shares for $200 any time between now and December. He pays me a premium, say $500, for this right, when IBM is at $194. I pocket the extra $500 income, and if the shares get pulled away from me at $200 per share, I still have a $600 profit there too. I just made $1100 instead of the $600 I would have made without selling the calls.

Of course, if IBM goes to $220 the next week, I might cry real tears, but there's no reason. Profit is profit, and it's never a bad thing. Never cry over a "could have made" deal, just be happy with the profits you have in hand.

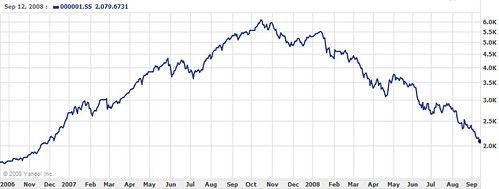

However, if IBM stays in the $185 to $195 range for many months, I continue to earn extra income by selling calls against my shares. When these expire, I can sell more. It's a constant stream of income. Of course, in events such as the financial crash of the second Bush administration, when most stocks fell 40%... you will still see a loss. However, the income from the calls will help take some of the sting out of it. If you own gold bars, the same principle applies, but you'll need a commodities broker to trade these types of calls on gold.

This isn't a quick fix or guarantee against buying bad stocks or investments. If you had Citibank or Lehmen shares in 2008 or 2009, nothing would have saved you. But it does create extra income against the solid stocks you own that are not built like a house of cards. Nothing is guaranteed in the stock market, not even with blue chips, so you need all the extra income you can get.

You can also sell deep in the money calls, when you think the stock may tumble but you don't wish to sell the shares. If CAT is at 115 and you suspect a fall coming, you can sell the 100 (strike price) calls, for about $1600 or more. If it falls to 98, you will keep my stock and get enough money from the call sale to cover most of your losses.

If you want to try it, look on your broker's website for Options quotes, and start shopping for a proper "call" to sell against your shares. I always sell long-term options, and it usually works well for my account.

More from this contributor (see also) :

How I Pick Winning Stocks Year after Year

5 Types of Companies You Should Never Invest In

How to Better Diversify Your Investments

stock promoters

Hover bike: Star Wars technology brought to life (VIDEO) — RT

A hover bike resembling the ones from 'Return of the Jedi' has been developed by a US firm, bringing science fiction to life.

Hover bike: Star Wars technology brought to life (VIDEO) — RTNBC <b>News</b> app for Xbox 360 brings streaming show clips to the <b>...</b>

While NBC News is no longer rocking the MS tag on its name, it's still tight with the Redmond crew and just launched a new app on the Xbox 360. Its well.

NBC <b>News</b> app for Xbox 360 brings streaming show clips to the <b>...</b>Anonymous releases how-to instructions on fooling facial - RT

Here's a predicament: you don't want the government using high-tech face scanning technology to track every inch of your walk to the post office, but you also don't want to take a sledgehammer to your neighborhood ...

Anonymous releases how-to instructions on fooling facial - RT